Clause 49

With the global standards of Corporate Governance reaching new levels continously and the need for the companies to maintain a high level of transparency in their processes , the SEBI has issued a directive on the lines of Sarbanes Oxley named Clause 49.

Clause 49 is pretty much on the lines of Sarbanes Oxley Act of 2002 provided by SEC for companies listed on US stock exchanges. According to Clause 49, the top management becomes directly accountable for all financial statements and internal controls of the organization, which is also the bottom line in case of Section 302 of Sarbanes Oxley Act of 2002.

With the Indian capital markets touching new heights and the steep increase in the retail investors taking shareholder confidence to a new high, corporate governance has become all the more relevant today. The significant addition under the revised Clause 49 is CEO and CFO certification on internal controls.

Clause 49 derives its base from the concept of Enterprise Risk Management. ERM is a framework that

- Establish, document, implement & monitor systems

- Mitigates operational risks and improves organization performance

- Sustains business goals

- Communicates value creation to key stakeholders

Clause 49 was made mandatory for all companies to comply by 31st December 2005. At a very high level, it gives guidelines on the composition of the board of directors and the composition of the audit committee. In addition, it makes necessary for CEOs/CFOs to

- Establish and maintain internal controls in their organization

- Report and certify effectiveness of, deficiencies in and changes to internal controls

- Disclose to the auditors and audit committee, of discrepancies and deficiencies in internal controls

- Initiate and implement remediation and risk mitigation towards such deficiencies

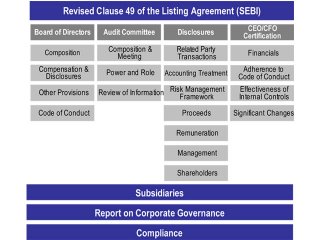

The figure below shows the exact meaning of the Clause 49 agreement.

Similar to the implementation of SOX, Clause 49 is also becoming a big project for most of the Indian companies and in a way is allowing them to clean up their processes and standardize them to match the global standards. Looking at Clause 49 only as a regulatory requirement and bringing about a adhoc change in the processes will bring in lot of problems for the enterprises in the future. A strong system of internal controls effected by Clause 49 is very important to ensure that the goals of enterprise risk management are met.

Compliance to Clause 49 gives a huge opportunity for the IT vendors in India to come out with a Indian version of SOX solution. Most of the Tier 1 vendors have been actively involved in the development of the SOX solutions which involved majorly the Risk Management System for many global companies. Technology as in SOX is going to play a very important role in adopting the compliance standard with minimal cost and maximum efficiency.

I hope the Indian firms will keep in mind the problems faced by US firms while in the first year of SOX and even after 3 years the companies are struggling to put the internal controls process in place. Clause 49 is not as big as Sarbanes Oxley but we need to remember that this is only the first step taken by SEBI on the road to effective corporate governance in India.

As someone has said rightly:

"Good Governance is Good Business, even if it costs a bundle. Businesses that have sound corporate governance policies outperform those with weak ones in terms of total shareholder return."

No comments:

Post a Comment